“Now I have nothing”

David Zhuang stood in Sydney International Airport with a canvas bag slung over his shoulder, ready to leave the city he has called home for more than eight years. He had built a life here, brick by brick.

Just hours before his departure, Zhuang lost more than half of his savings.

His eyes brimmed with tears, his voice quivered as he shivered in the cold. “I couldn’t find anyone to help,” he whispered hopelessly.

Earlier that day, he had received a call from a scammer pretending to be the Commonwealth Bank, using its official bank number. The caller claimed there was an irregular transaction and that he needed to transfer his money to a safe account using mobile numbers as the PayID.

He transferred almost $30,000 to the scammers.

“I just wanted to go home with what I earned these years,” Zhuang said. “Now I have nothing.”

After reporting the case to the police, Zhuang said he received a case number. The police followed up weekly on the progress of retrieving money from the bank.

“The police didn’t really help,” he said. “They told me from the start there’s not much they could do.”

Apart from the challenges in reporting, people with low or no income cannot afford private legal services. “Starting a lawsuit or finding a lawyer is way more expensive,” he said.

Losing an entire savings in an instant is not uncommon.

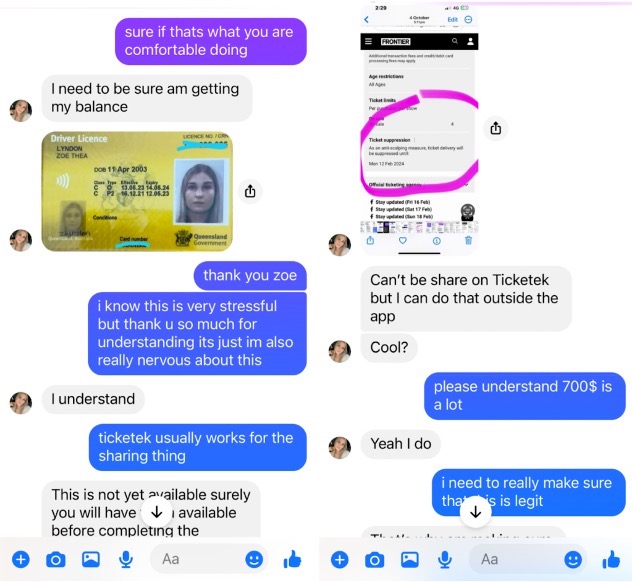

A similar but less costly scam impacted Virginia Zhang, who lost $600 while buying Taylor Swift concert tickets on Facebook.

The scammer used “a real ID” from another person’s account, convincing her to transfer money by sending fake Ticketmaster screenshots.

“So that case was actually like an identity theft. Whoever hacked into her account actually stole her personal ID from her chat history,” she explained. “It was so convincing. It was a girl similar to my age, and she had given me her ID.”

However, Zhang could not retrieve her money as it was transferred overseas outside Australian jurisdiction making prosecution difficult.However, Zhang could not retrieve her money as it was transferred overseas outside Australian jurisdiction making prosecution difficult.

Last year, Australians lost $2.74 billion to scammers, a 13 per cent decrease from 2022 but still doubled from 2021, the latest Australian Competition and Consumer Commission’s (ACCC) Targeting Scams report found.

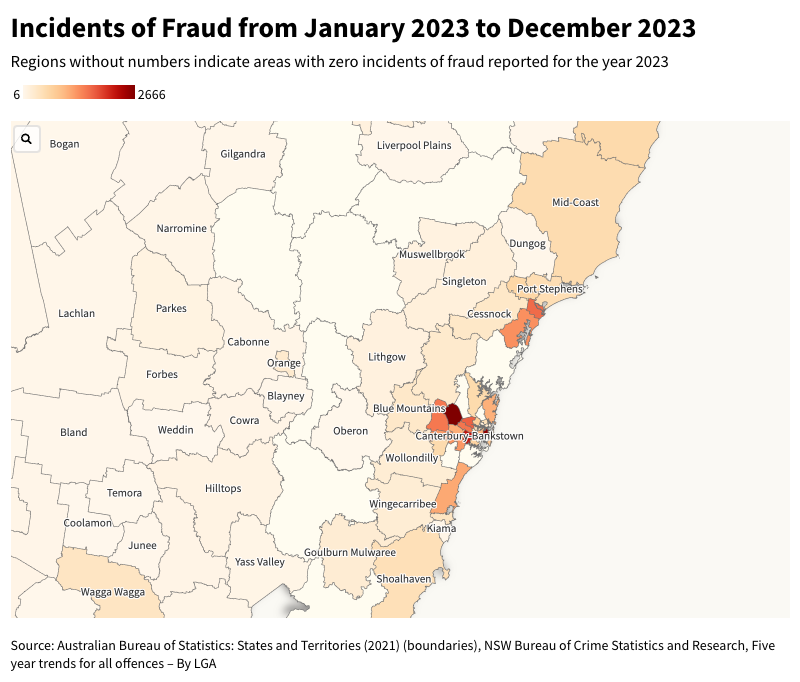

Although scam losses decreased in 2023, they were still almost $1 billion higher than two years ago. The rate of fraud incidents in NSW remained stable in 2023, with a total of 46,811 cases. Sydney had the highest number of scams.

A recent National Anti-Scam Centre report revealed scams targeting culturally diverse communities and international students made a total of $13.9 million in reported losses for threat-based scams. This is similar to levels in 2022.

Andrew Tiedt, a Law Society of NSW Accredited Specialist in criminal law, explained that scam victims often cannot protect themselves and are more susceptible to fraud.

“In the Australian criminal justice system, there are many people being prosecuted. Often it’s people who’ve played some sort of supporting role in the scam,” he said.

This includes people whose bank accounts are used by friends to launder money or receive funds from scam victims. Tiedt noted that in some cases, people in Australia are “deliberately, often through naivety being pulled into the process”.

Although many people are prosecuted, in total it’s “a pretty small proportion”, he said.

“That is because the scammers are often overseas, so it’s pretty difficult to get them prosecuted in Australia. But those involved in Australia do get prosecuted and receive serious penalties where they have committed criminal offences.”

Overseas fraud on the rise

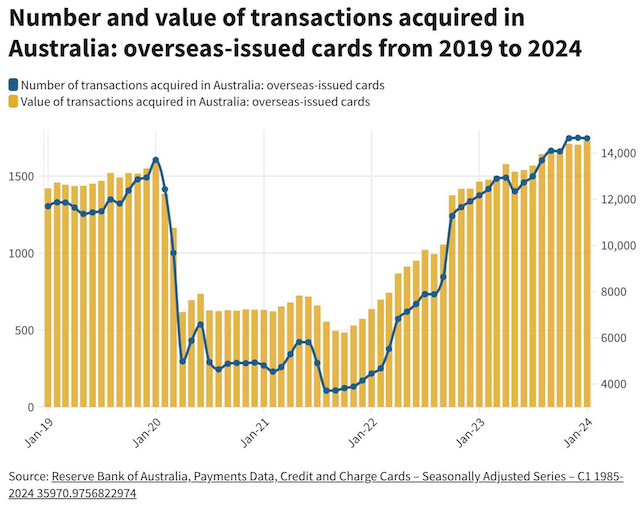

Card fraud remains a significant issue for Australian consumers, with a 35.6 per cent increase to $677.5 million in 2023, reaching pre-pandemic levels, according to the Australian Payments Network.

Overseas merchant fraud accounts for half of all card-not-present (CNP) fraud in Australia.

According to Payments Statistics from the Reserve Bank of Australia, the CNP fraud rate for overseas merchants using Australian cards increased by 16 per cent. Fraud losses doubled to $295 million.

The domestic fraud rate is significantly lower, compared to the rate for CNP transactions involving overseas cards.

This chart shows that both the number and value of overseas transactions doubled from 2022 to 2024.

Reports to authorities decrease

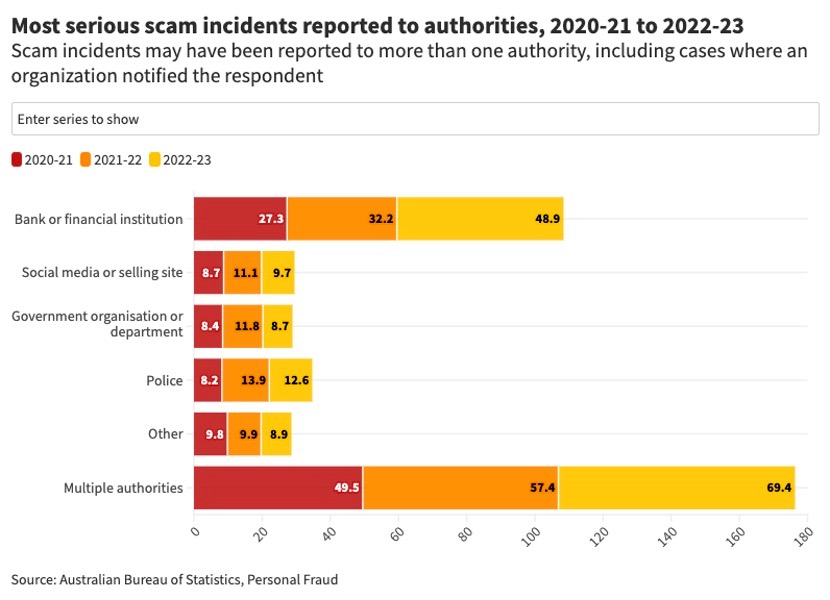

An ACCC’s report on scams activity released last year reported a 16.5 per cent decrease to Scamwatch. In 2022-23, 69 per cent of Australians who experienced a scam notified an authority, driven by a 10 per cent increase in reports to banks or financial institutions.

Victims reported serious scams to banks or financial institutions three times more often than to the police or government organisations.

However, reporting scams to authorities can be challenging.

“People are embarrassed to say they’ve been tricked,” Tiedt, the Law Society of NSW Accredited Specialist in criminal law, said.

He explained that being aware of scams and to spot them “is not easy”, especially for people who work in crime related fields and cannot recognise scams “a mile away”.

“Many people aren’t as tech savvy or as law savvy and are more easily fooled,” he said.

“People often don’t even know they can be scammed, so anything the government can do to support and encourage people to complain is worth doing.”

Tiedt said the government in response can “better fund free or subsidised legal services” to help victims who cannot afford private legal representation.

He also identified organisations such as Community Legal Centres, Legal Aid, and the Aboriginal Legal Service as needing “more funding” to improve legal education.

“There are lots of people who value higher quality, more intense, more focused legal services, and I’m happy to serve those people,” he said.

The Law Society of NSW produced a podcast Lawfully Explained in early 2022, inviting lawyers to explain legal help and understanding rights to the public.

Fraud is a growing problem and will likely continue to rise with new technologies and payment options.

“There’s a lot of room for improvement in that area of legal education,” Tiedt said.